There is so much paperwork associated with filing your federal and state income taxes. Try this simple method for storing your papers.

Disclaimer: This information is not meant to be financial advice. We are simply sharing information that has worked for our family. Please be sure to read our disclaimer statement. Click here

Start with a simple folder

A simple two-pocket folder will be enough for this project. You don’t need anything fancy or expensive. Just something to hold all of the papers until you’re ready to file your taxes.

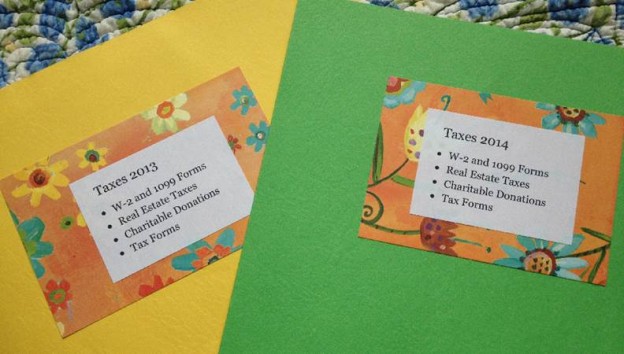

Label your folder

You can write it, type it or even make a label using a label maker. Labeling your folder helps keep everything organized. We’re including this simple printable. Just print and attach it to your folder. It includes a tag for 2020 and 2021 folders.

What goes in the tax folder?

Throughout the year, you’ll come across various papers that you will need again at tax time. This includes papers like:

- Real Estate Tax Bills

- Excise Taxes on vehicles

- Lists of items donated to charity, and receipts from charities

Note: We opt to keep our medical receipts and paperwork in a separate folder.

Paperwork to watch for in January

In January, you’ll start to receive important year-end documents in the mail. Some of the most common documents include:

- W-2s – Wage and Tax Withholding Summary

- 1099s – Bank interest and investment income summaries

- Mortgage Interest Summaries

- Federal and State Tax Forms

Once your folder is established, simply add these documents to the folder.

You’ll want to make sure to pick up your mail everyday in January. Tax documents often contain personal information, so it’s best not to leave mail overnight in your outdoor mailbox.

Using Manila File Folders

If you have several documents under one category, label a manila file folder and keep it within your tax folder. We find it especially helpful to use a manila file folder for our charitable contributions. Throughout the year, we donate non-cash items to charity. We keep a list of the items along with their values. We also include the receipts received from the charitable organization.

Timing

For the first three months of the year, you’ll work with two folders. One for the prior year, so you can complete your tax returns which are typically due on April 15th. The second folder is for the current year. If you make a donation, or receive a real estate tax bill, you’ll want to file the paperwork in this folder.

Making it pretty

It helps if you can use a bright, happy color for these folders. We also opted to use a little bit of floral scrapbook paper to add to the cover. It makes the file easy to read, and more motivating to use.

Need a few more ideas? Check out the following articles for additional information:

How to Keep Track of Your Charitable Contributions

Too much mail? Tips for staying on top of your mail

Monthly Expense Tracker: It’s not what you make, it’s what you spend